The most typical third-party payroll integrations are employee time and attendance monitoring, scheduling, retirement plans and well being benefits, recruiting, compensation management and general accounting systems. Many small businesses discover it most effective to buy their payroll and HR assist services from the same vendor, such as Gusto or Rippling, both of which promote plans that mix the 2 functions. Others choose merchandise that combine payroll with different accounting operations such as QuickBooks Payroll and Wave Payroll.

Many small to mid-sized corporations are looking for options that not solely automate payroll but additionally present HR help, benefits management, and real-time reporting. QuickBooks Time is a time-tracking answer that integrates seamlessly with QuickBooks Payroll. Employees can clock in and out using a mobile app, a web quickbooks payroll browser, or a time-kiosk.

QuickBooks Payroll also made it to our listing of greatest payroll software for small businesses. Sure, you’ll have the ability to upgrade your QuickBooks Payroll plan as your business grows and your payroll wants change. Upgrading permits you to access further options and capabilities that may be needed for managing a larger workforce or extra complicated payroll necessities.

Explore Other Payroll Options

The data can be filtered in more than a dozen ways, including internet pay, particular funds and payroll tax category. It’s no thriller why SMBs that use market leader QuickBooks for accounting could be drawn to the company’s payroll resolution, a mixture that’s out there in three separate bundles from the company. Those merchandise are removed from the one integrations QuickBooks Payroll provides. In truth, there are tons of of third-party integrations obtainable for QuickBooks Payroll, including cost and expense-management instruments, as nicely as dozens of non-QuickBooks accounting apps. Each home-owner is conscious of that there’s a time to do it yourself and a time to let the pros take over.

- If you’re switching to QuickBooks Payroll from ADP, Paychex or Gusto, you can migrate your worker data and payroll historical past directly to QuickBooks Payroll.

- For the ultimate word safety net, the Elite plan presents $25,000 in Tax Penalty Safety, which covers penalties even when the mistake was an error on your half.

- The rise in distant employment gives SMBs an expanded pool of potential candidates for their open positions.

But Gusto consists of more various perks, such as well being financial savings accounts and life insurance options. And competitors like ADP, Paychex, and UZIO have better payroll-plus-HR packages with extra complete HR solutions than QuickBooks. All the payroll services in our rankings calculate and file your business’s payroll taxes, and many pay the taxes automatically.

What Are The Benefits Of Payroll Software?

This time is usually freed up by eliminating guide data entry, automated tax filing, and the employee self-service portal. These cloud services seamlessly integrate with QuickBooks On-line accounting software, which is a massive win because all your payroll expenses automatically sync to your books. Gusto customers can get a same-day direct deposit provided that they sign up for Gusto Pockets. Gusto offers a variety of integrations with many different software program techniques.

After placing the ten merchandise through two rounds of evaluations and hands-on testing, we establish the one attribute that sets every other than the crowd. Based on person critiques and trade popularity, OnPay persistently receives high marks for buyer help, especially for small companies. ADP additionally presents intensive assist choices, including 24/7 availability for certain plans.

Also, Gusto calculates, files and pays native tax obligations automatically. Setting up QuickBooks Online (QBO) Payroll Service can simplify payroll processing for your small business by automating tax calculations, payroll processing, and compliance with federal and state rules. QuickBooks Online Payroll presents seamless integration together with your bookkeeping and tax information, lowering the time and effort required to manage payroll. With businesses dealing with rising compliance rules and workforce administration https://www.quickbooks-payroll.org/ complexities, streamlined payroll and HR software has become a necessity quite than a luxury.

Handle Payroll Sooner Right In Enterprise With Quickbooks Desktop Payroll

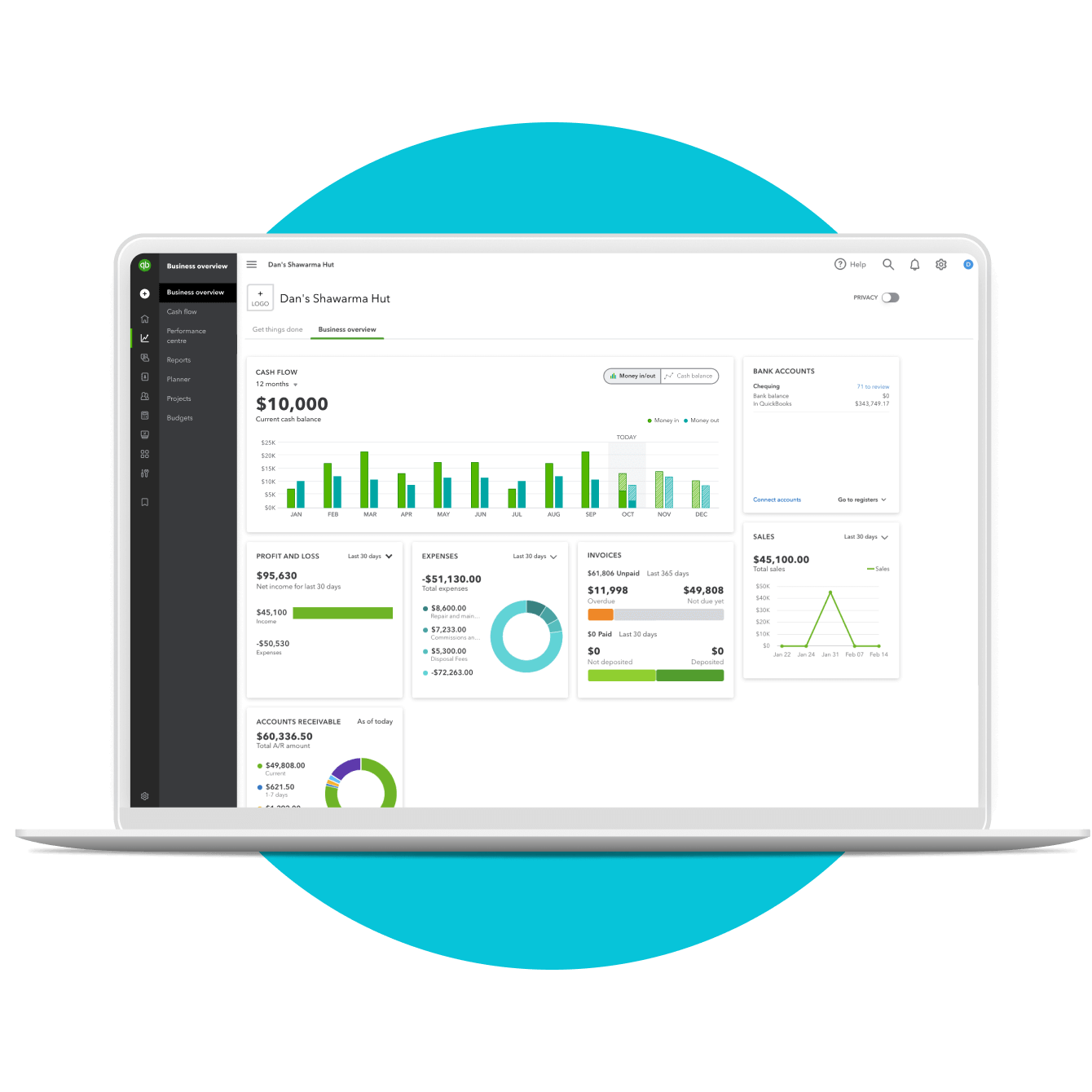

QuickBooks Payroll goes past paychecks to help you manage your funds. With over 15 customizable payroll stories, you possibly can view payroll tax deductions, financial institution transactions, total payroll prices, and extra. Real-time knowledge means it’s easy to make smarter decisions for your corporation. That means, in addition to automated payroll, you’ll obtain full-service features. Higher Business Advice’s annual rankings evaluate HR and payroll solutions primarily based on industry needs, person suggestions, and software innovation. QuickBooks Payroll has constantly ranked among the many leading platforms as a outcome of its user-friendly expertise and comprehensive set of tools tailored to small and mid-sized businesses.

Intuit workforce portal is an employee self-service platform that enables workers to view their paychecks and W-2s. They can even apply for depart, view depart balances and enter time sheets on the portal. You can choose whether you want your workers to have access to the workforce portal or not while including their names to the payroll database. QuickBooks Payroll is a superb app from Intuit for managing worker payroll for a small business. If you may be already utilizing QuickBooks On-line for accounting, the 2 combine seamlessly, enabling you to handle each accounting and payroll from a common platform.